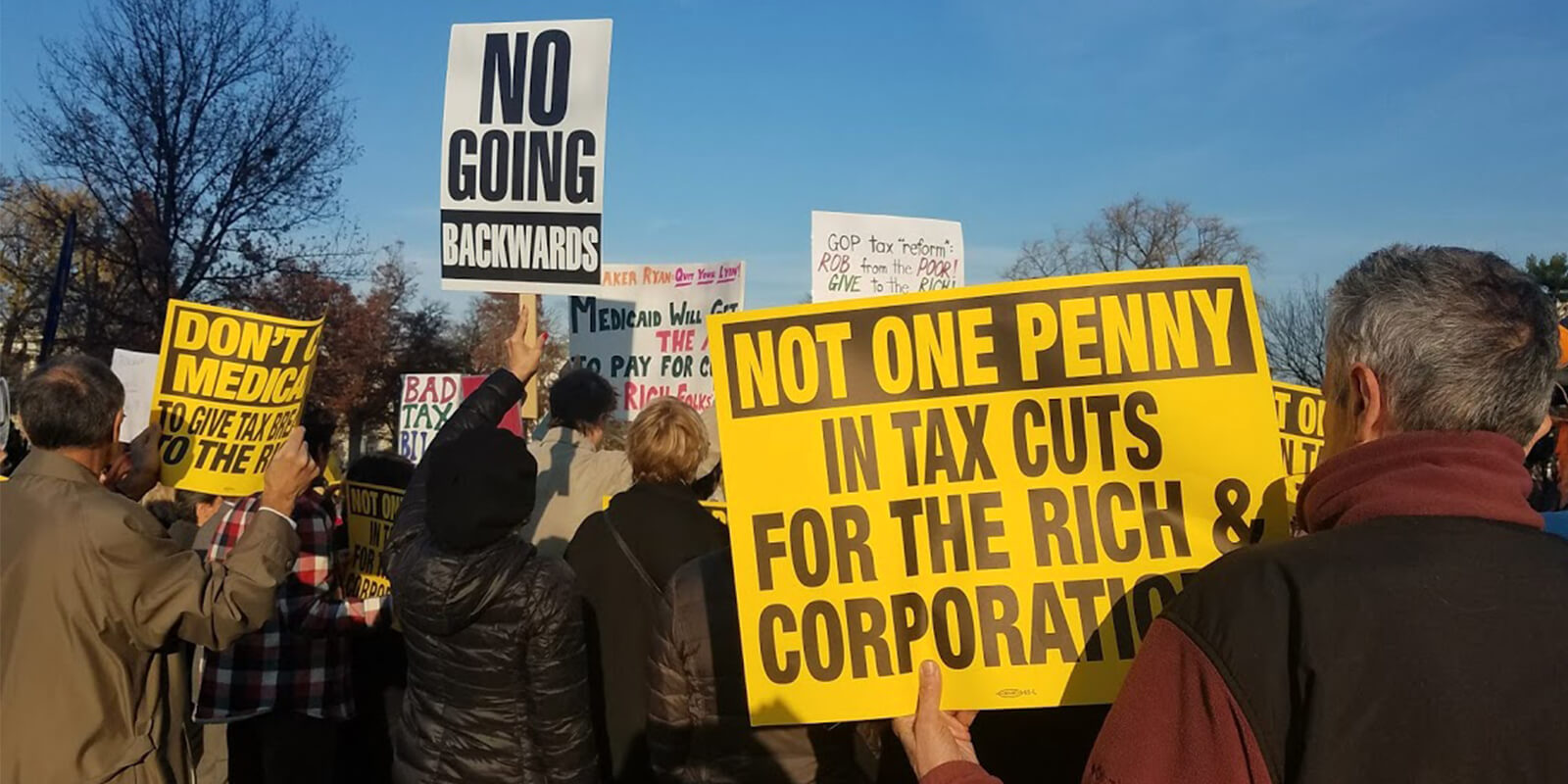

In the dead of night, the U.S. Senate passed a bill designed to enrich corporations and the super-wealthy by taking vital services and income from hardworking Americans. The bill would raise taxes on 87 million working families while billionaires get massive tax breaks. Senior citizens will be confronted with more than $400 billion in cuts to Medicare. Health care will become a mere memory for the 13 million working people expected to lose their health coverage.

But there’s still time to act. The Senate bill is not yet law. Congressional leaders are meeting to hammer out a bill that can pass the House and the Senate. Your voice is needed to stop the damage about to be inflicted on the working people of America.

Senate leaders brought a bill to the floor in the wee hours of Saturday. The bill, which passed by the narrowest of majorities, is a dream come true for the well-heeled corporate lobbyists who wrote it – more than 60 percent of the tax cuts go to the richest 1 percent. Who pays for it? Working families, seniors and kids.

Make no mistake: This bill reaches into nearly every aspect of the lives of regular people.